Trip Interruption Benefits

What is Trip Interruption?

Trip Interruption Coverage is there to offer protection against your trip in the event that it falls short due to unforeseen circumstances—if it gets interrupted. Interruption Coverage covers events that may cause a premature trip home:

- Serious sickness

- Severe weather

- Family emergency

- Quarantine

- Evacuation

- Military duty

- An early departure

Think of Trip Interruption Coverage as coverage against an outside event that prevents you from continuing your trip as intended. If you have to cut things short unexpectedly, Trip Interruption Coverage is here to offset that.

Trip Interruption Coverage typically covers expenses such as the cost of unused transportation, accommodation (hotels, etc.), and other expenses incurred because of the interruption. The exact coverage and benefits vary depending on the policy: some cover 100-200% of the total trip cost, while others cap coverage at a set amount. Most policies require a 72-hour notification window to let the parties (including your insurance provider) know that you will be employing the interruption benefits.

Why Get Trip Interruption Coverage?

Think of it this way: you’re on a week-long romantic getaway. You have active excursions planned during the day, and poolside relaxation on the schedule for the evening -- but two days in, you sprain your ankle. You can’t safely do any of the snorkeling, swimming, hiking, or strolling that you had planned. Even after a day off, taking it easy, you see your ankle is worse, and you’d like to get home for treatment before it becomes too serious. Here, Trip Interruption Insurance can offer reimbursement for your unused lodging, original flight cost, and transportation costs – because your trip was interrupted and was not able to be fulfilled according to schedule.

Reimbursement requires a few careful steps, which we’ll outline below, but that is the essence of trip interruption coverage.

If you do not have trip interruption coverage, any cancellations for lodging/hotels, transportation, or flights are done at your own risk—and the mercy of the merchant you are working with. Whether hotels allow last-minute cancellations or refunds will be on a case-by-case basis, and most flight transfers will involve change fees and high costs. Trip Interruption Coverage could help mitigate these fees, so that you can get reimbursed and return home safely.

The Most Common Reasons People Have to Cut Trips Short

The three most common reasons people cut trips short are because of sudden illness/injury, severe weather, and family emergencies.

These are also the most common reasons to opt for Interruption Coverage.

What Does it Not Cover?

Trip Interruption Insurance does not cover every unexpected incident. Exclusions will vary by each policy, but in general, it does not cover:

- Injury caused by being intoxicated or under the influence

- Committing an illegal or criminal act

- Injury related to certain extreme activities (think skydiving, mountaineering, or deep-sea scuba diving)

- Pre-existing medical conditions

- War

Trip Interruption Vs. Other Travel Coverage?

There are several types of travel insurance coverage plans on the market, so let’s clear up some terms for you:

Trip Interruption vs. Trip Cancellation Insurance

Trip Cancellation Coverage is for situations when you have to cancel your trip before you leave. Usually, the benefits of cancellation coverage are in the form of refunds (airfare, tour booking, or hotel reservations). It is similar to interruption coverage but often has additional stipulations about when and what applies.

Many insurance plans offer “cancel for any reason” (CFAR) op-ins, but these usually only provide 75% reimbursement and are only valid if your trip is canceled before you leave.

Trip Interruption vs. Trip Delay Insurance

Trip Interruption Coverage is different from Trip Delay coverage. Trip Delay coverage helps off-set costs associated with a short pause in your travel plans. The length of the “pause” depends on each plan, but in general, think of it like this:

Your flight out of Denver is scheduled for 6pm, but a massive storm comes in, and the next available flight is not until 8am the next morning. Trip delay coverage would generally cover things like your meals for the duration, hotel for the night, and the cost of the hotel room you had booked but did not use (if the hotel won’t refund you).

Here, your trip didn’t stop prematurely, it was just delayed a bit.

Trip Interruption Coverage, instead, would come into play if you are already on your trip, but severe weather causes evacuation, or you incur an illness (like that sprained ankle) that prevents you from continuing.

But Do I Need Trip Interruption Coverage?

Whether Trip Interruption insurance is right for you or not depends on a few things:- Type of trip you are taking

- Total trip cost

- Your personal risk tolerance

For trips lasting multiple days, international, and/or active excursions (such as cruises, tour guided activities), trip interruption insurance may be recommended, since the longer duration the trip, the greater room for problems to pop up.

The Trip Interruption benefit can provide coverage for unexpected events such as sickness, weather-related cancellations, and other eligible events that can cause you to interrupt your trip.

Trip Interruption also allows travelers to rejoin their trip after an interruption has occurred.

When Does Trip Interruption Coverage Begin?

Requirements before coverage may begin:

- When a specific travel package has been selected

- On the day after the required premium for such coverage is received by the authorized representative

Once requirements are met, your coverage will begin on the scheduled departure date.

When Does Trip Interruption Coverage End?

Coverages will end the earliest of the following:

- The scheduled return date as stated on the travel tickets

- The date and time you return to your origination point is prior to the scheduled return date

- The date and time you deviate from, leave, or change the original trip itinerary (unless due to unforeseen and unavoidable circumstances covered by the policy)

- If you extend the return date, coverage will terminate at 11:59 P.M., local time, at your location on the scheduled return date unless authorized in advance by our travel agent.

- When your trip exceeds 90 days

- The return date as stated on your purchase confirmation

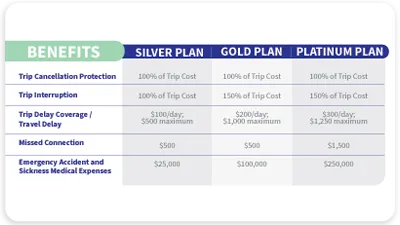

Travel plan benefits vary by selection. Explore our Silver, Gold, and Platinum plans.

How to get Trip Interruption Coverage

Receive a free quote online within minutes. You can also call us to speak with our licensed Travel Insurance Advisors:

Call 855-327-1441

Monday-Saturday, 8 AM-7 PM Central Time

Disclaimer: It is important to note that the specifics of trip interruption will depend on the date of purchase and state of residency. Customers are advised to carefully review the terms and conditions of their policy and to contact AXA Partners with any questions or concerns they may have.

What Qualifies as Trip Interruption?

Okay, what exactly qualifies under trip interruption protection? AXA Travel Protection coverage can provide travelers with coverage when they face situations that force them to interrupt their travel schedule:

|

Incident |

Scenario |

Plans Covered |

|

Health-Related Interruptions |

If you, as a traveler, suffer from sickness, accidental injury, or face a tragic event leading to death or a certified physician deems it necessary to impose medical restrictions preventing your continued participation in the trip due to the reasons listed above, this coverage comes to your aid. A physician must advise trip cancellation on or before the scheduled return date. |

Silver Plan |

|

Family and Travel Companion Health |

This coverage extends to the health of family members or traveling companions booked to join you on your trip. It applies if they fall ill or sustain accidental injuries while on the trip, requiring necessary treatment and imposing medically certified restrictions on their participation. |

Silver Plan

|

|

Non-Traveling Family Member |

In the unfortunate event of sickness, accidental injury, or death of a non-traveling family member, AXA Travel Protection's trip interruption coverage ensures you are covered. |

Silver Plan

|

|

Host at Destination |

If the host at your trip's destination faces death or hospitalization during your visit, you can rely on this coverage to assist you. |

Silver Plan

|

|

Employment-Related Interruption |

Employment-related issues, such as termination or layoff from full-time employment after one year of continuous service through no fault during your trip, are covered. |

Silver Plan |

|

Employment Transfer |

If your employment requires a transfer of 250 miles or more during your trip, provided you were employed with the transferring employer on your effective employment date, and the transfer necessitates relocating your home, this coverage applies. |

Silver Plan

|

|

Business Disruption |

If you or your traveling companion's company becomes unsuitable for business due to fire, flood, burglary, vandalism, or other natural disasters, and you are responsible for policy and decision-making within the company and are actively involved in disaster recovery, the coverage is valid |

Exclusive to Platinum Plan |

|

Required Work |

If you or your traveling companion are required to work during the trip, substantiated by a notarized statement from an officer of the employer, this benefit provides coverage. It is unavailable to independent contractors, temporary employees, self-employed individuals, or company owners or partners. |

Exclusive to Platinum Plan |

|

Company Events |

Your or your traveling companion's company is directly involved in a merger, acquisition, government-required product recall, bankruptcy or default proceedings, and active involvement in the said event makes you eligible for coverage. |

Exclusive to Platinum Plan |

|

Military Duty |

If a previously approved military leave is revoked or a military reassignment during the trip, this coverage provides protection. It excludes war-related incidents. |

Silver Plan |

|

Weather and Natural Disasters |

Inclement weather causing the complete cessation of services for at least 48 consecutive hours by your common carrier or a natural disaster at your destination rendering accommodations uninhabitable can offer coverage. |

Silver Plan |

|

Terrorist Incidents |

In the event of a terrorist incident occurring in your departure city or a city listed on your trip itinerary during your trip, you are covered. It is important to note that benefits are not provided if the travel supplier offers a substitute itinerary. |

Silver Plan |

|

Assault and Other Incidents |

If you or your traveling companion are victims of felonious assault, experience hijacking, quarantine, jury duty, subpoena, or if your home becomes uninhabitable due to a natural disaster or burglary during the trip, this coverage applies. |

Silver Plan |

|

Traffic Accident |

A direct involvement in a traffic accident while en route to departure, supported by a police report provided to AXA, is a valid reason for trip interruption coverage. |

Silver Plan |

|

Travel Supplier Default |

The coverage extends to cases of bankruptcy or default of a travel supplier, leading to a cessation of travel services during your trip. If no alternate transportation is available, benefits are provided, and if alternate transportation is available, the coverage is limited to change fees to transfer to another airline. |

Silver Plan |

|

Common Carrier Strike |

In the event of a strike by the common carrier with whom you or your traveling companion are scheduled to travel, resulting in complete cessation of services for at least 48 consecutive hours, this coverage comes into play. |

Silver Plan |

How Much Does Trip Interruption Coverage Cost?

All three of AXA’s Travel Protection plans include Trip Interruption coverage; maximum coverage per person is up to:

Silver

Maximum Benefit: 100% of Trip Cost

Reasonable Expenses Per Day: $100

Gold

Maximum Benefit: 150% of Trip Cost

Reasonable Expenses Per Day: $100

Platinum

Maximum Benefit: 150% of Trip Cost

Reasonable Expenses Per Day: $100

How to get a Travel Protection Quote?

Receive a free quote within minutes, or call us at 855-327-1441 Monday-Saturday, 8 AM-7 PM Central Time to speak with our licensed Travel Insurance Advisors.

Disclaimer: It is important to note that the specifics of trip interruption will depend on the date of purchase and state of residency. Customers are advised to carefully review the terms and conditions of their policy and to contact AXA Partners with any questions or concerns they may have

Other Things to Know

Filing a Claim

If your trip gets delayed or interrupted, you must show that you’ve done everything you can to still continue with your scheduled plans. A common example is this: Let’s say you’re taking a 5-day cruise, but a storm grounds your plane for 2 days. By the time you get to your cruise destination, the ship has literally already sailed, and you can’t find a flight to your next port. This may be a good case where you may get interruption coverage.

Just remember that you still have to show that you did everything you could to make those original plans: most plans require that demonstrate that you still tried to reconnect with your cruise or tour group, that this was, in fact, an “interruption” that caused you to miss your trip. To do this, it’s generally a good precaution to keep your receipts, document your efforts, document your experience, and keep all required documentation. Most coverage also abides by a 72-hour notification rule, but make sure you know the ins-and-outs of your specific plan beforehand.

Interruption coverage usually provides a percentage reimbursement for covered scenarios. The amount of reimbursement and coverage will depend on which plan you select.

If you need assistance, you can always contact AXA’s Travel Support Line at: 855-327-1441.

Why choose AXA Travel Protection?

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include:

- Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency

- 24/7 global team of travel experts that offers assistance and assurance while traveling

For more information, contact us by phone at 855-327-1441 or here for online help options.